Making money from smartphone and tablet apps is a tough business. That's why there are so many "apps monetisation" conferences, consultants of varying quality and reputation, and an ever-growing sector of companies trying to make money from apps with platforms that help other companies make money from apps. In theory.

You don't have to look far for big numbers giving hope to all of the above. Take analytics firm App Annie's latest report, which is aimed at investors eyeing the apps market, complete with its vision of a combined iOS and Android market "nearly worth $1 Trillion today".

Wait, what? Apple said in June that it had paid out $10bn to iOS app developers since the launch of its App Store in 2008, which by my reckoning (once you factor Apple's 30% cut of app sales back in) leaves a mere $986bn to be mopped up by Android, Windows Phone and BlackBerry.

But App Annie isn't talking about revenues, of course. It's talking about the combined market cap of the 37 publicly-traded companies which appear in a chart of the 100 top app publishers by revenue on iOS and Android.

That's a list that includes Apple, Microsoft, Disney and Time Warner – $841.6bn market cap between them – so those dreams of an apps economy worth $1 trillion will have to remain dreams for now.

(In fairness, the report is aimed more at persuading companies to invest in firms a bit lower down the market-cap chart, for example picking out GungHo Online and KLab as two companies whose share price jumped after good news on their app businesses.)

Still, there is evidence elsewhere of strong growth in the money being made from apps on an industry level. App Annie claims that gross revenue for the App Store and Google Play has more than doubled over the past year, and Apple and Google's own figures support that.

It took Apple four years to pay out its first $5bn to iOS app developers, but only a year to pay the next $5bn. In Google's financial earnings call this week, meanwhile, chief executive Larry Page told analysts that "we already paid out more money to Android developers this year than in the whole of 2012".

He didn't say how much that was, although Apple's 50bn downloads and $10bn payouts only requires simple maths to calculate that the average iOS download – including free apps – costs around $0.29 (since we're adding Apple's 30% back onto the $10bn again).

Another mobile analytics company, Flurry, has just published its own stats to shed more light on apps pricing trends, based on four years of data gleaned from iOS and Android apps using its tools.

Many of the conclusions are logical, but good to have updated numbers for. The company says that 90% of iOS apps are now free to download – up from 84% a year ago – with another 6% costing $0.99.

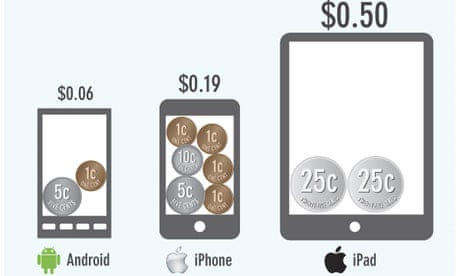

Flurry also estimates that the average Android app download costs $0.06 – again, this includes free apps – with the figure rising to $0.19 for iPhone and $0.50 for iPad.

"Some might argue that this supports the idea that "content wants to be free". We don't see it quite that way. Instead, we simply see this as the outcome of consumer choice: people want free content more than they want to avoid ads or to have the absolute highest quality content possible," suggests Flurry.

It also suggests that the data points to a separate conclusion: that advertising may become much more of a factor in the way people make money from their apps in the months and years to come.

"While consumers may not like in-app advertising, their behavior makes it clear that they are willing to accept it in exchange for free content, just as we have in radio, TV and online for decades. In light of that, it seems that the conversation about whether apps should have ads is largely over," claims Flurry.

"Developers of some specialized apps may be able to monetize through paid downloads, and game apps sometimes generate significant revenue through in-app purchases, but since consumers are unwilling to pay for most apps, and most app developers need to make money somehow, it seems clear that ads in apps are a sure thing for the foreseeable future. Given that, we believe it's time to shift the conversation away from whether there should be ads in apps at all, and instead determine how to make ads in apps as interesting and relevant as possible for consumers, and as efficient and effective as possible for advertisers and developers."

The caveat this time is that besides its analytics tools, Flurry also runs a mobile advertising business called AppCircle. It thus has a keen interest in talking up the importance of mobile ads (and the need for better targeting of those ads).

In any case, estimating the overall value of the apps market may be a fool's game. Money spent on app downloads and in-app purchases is trackable (or at least estimable), and there is no shortage of predictions for how much is being spent on mobile advertising – although most forecasts I've seen don't distinguish between ads within apps and on mobile websites.

But the value of apps is often felt elsewhere. How many people signed up for a Netflix subscription on the basis of being able to watch films on a tablet? How many of Spotify's 6m+ subscribers are paying the full £9.99 a month because they want to listen to music through its mobile apps? Financial Times subscriptions, Microsoft Office 365 subscriptions, the $20bn of products eBay expects to be sold through its mobile apps and sites in 2013...

We'll keep seeing big numbers bandied about apps as a standalone industry, but the real value of these things will often be about being a prominent ingredient in wider digital services that span screens and platforms according to the needs of the people using them.

It'll be less about the size of a notional "apps market" (whether $1 trillion or less) and more about how smartphones and tablets are adding value to industries as diverse as music, entertainment and games, through to healthcare and professional services.

Comments (…)

Sign in or create your Guardian account to join the discussion