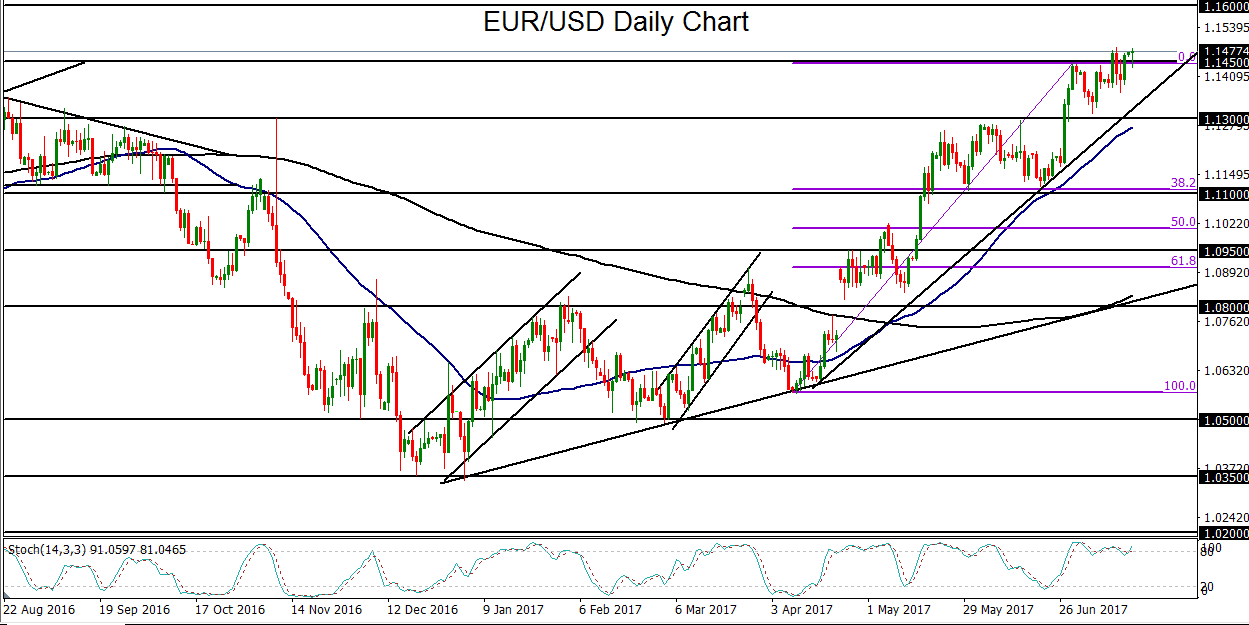

The US dollar took a breather and was little changed on Monday after having been pressured for much of last week due to dovish signals emanating from key Federal Reserve speakers, including Chair Janet Yellen. Those dovish indications have come at a time when concerns about low inflation in the U.S. have already begun to erode expectations of an aggressive pace of monetary policy tightening by the Fed. The resulting pressure on the dollar last week helped boost EUR/USD to a new 14-month high, extending the sharp uptrend for the currency pair that has been in place for the past three months.

This week, EUR/USD focus shifts away from the Fed for the time being, as the European Central Bank takes center stage on Thursday in helping to determine the currency pair’s near-term trajectory. Rumors have been brewing and the markets have duly taken notice of the possibility that the ECB may be following other major central banks – including the Bank of Canada and Bank of England – in shifting towards a more hawkish stance. In the case of the ECB, this could possibly mean earlier-than-expected tapering of the central bank’s extensive stimulus (QE) programs amid a strengthening Eurozone economy and in the wake of ECB President Mario Draghi’s recent comments on rising inflation in the Euro area.

If any such hawkish indications emerge on Thursday, increasing market support for the euro could further extend EUR/USD’s uptrend towards higher highs. Of course, if Draghi vehemently and dovishly denies the prospect of tapering earlier than anticipated, the euro is very likely to drop sharply on a rapid withdrawal of market support for the shared currency.

Against this ECB backdrop, EUR/USD upside momentum continues to be strong for the time being. A bullish breakout to new highs may be imminent, which could push the currency pair towards the next major upside target within the current uptrend at the key 1.1600 resistance level. Such a move would likely be contingent upon any signal from the ECB suggesting tighter monetary policy on the horizon. To the downside, if the ECB continues its characteristic dovishness, a resulting EUR/USD drop could pressure the currency pair back down to major support around the 1.1300 level.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.