EUR/USD Current price: 1.1892

After hesitating during the first half of the day, the greenback came back with a vengeance alongside Wall Street's opening, on mounting rumors the US government is stepping on the gas over the long awaited tax reform. There was no official announcement on the matter, with all coming from President Trump twitter, in where he urged the Congress to act quickly on his tax reform plan. The EUR/USD pair that traded as high as 1.1994, ended up breaking below the 1.1900 figure, to settled not far above a daily low of 1.1879. The only piece of relevant data released this Wednesday was the US producer price index, which came in below market's expectations. Despite rebounding in August, the index for final demand advanced just by 0.2% monthly basis, and by 2.4% when compared to a year earlier. Market's attention is anyway on upcoming final August CPI readings, to be released this Thursday.

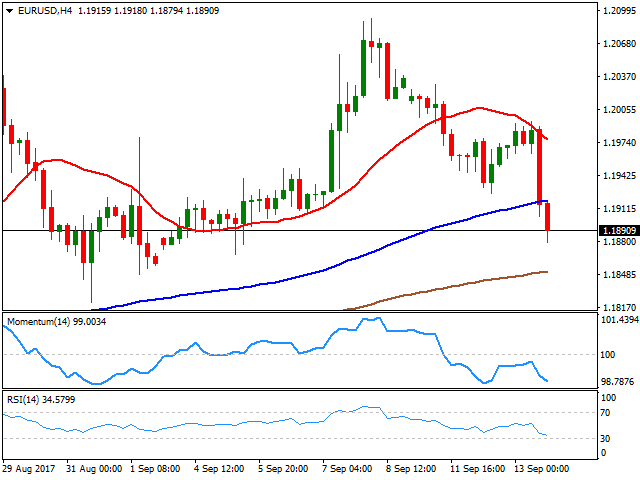

Failure to regain 1.2000 is certainly discouraging for bulls, and the pair could clearly fall further, although long term the decline continues to look corrective, specially as there's no real background for a dollar rally. A long term ascendant trend line coming from the 1.0600 region, comes today around 1.1795, becoming a critical support, as a break below it will indicate that a steeper correction is under way. In the meantime, and for the short term, the pair is biased lower as in the 4 hours chart, and after failing to surpass its 20 SMA, the pair broke below the 100 SMA, whilst technical indicators maintain their strong downward slopes within negative territory. Last week low at 1.1822 is now the immediate support, en route to the mentioned trend line around 1.1795.

Support levels: 1.1870 1.1825 1.1795

Resistance levels: 1.1930 1.1965 1.2000

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.